This article is written by my wife Shivani who is a senior executive at a public sector bank.

We all are aware of the importance of getting a periodic health checkup. It is as important to do a periodic checkup of your credit health. But, most of us realize the importance of a credit score when we need a loan. I have seen people come to the bank to apply for a loan and then get a nasty surprise when their loan gets rejected due to a bad credit score. There have also been instances when despite having a good credit score the loan application gets rejected because of incorrect information in the report. Even a minor error in a credit report comes with a huge cost and can trouble you in times of need.

Now, there are quite a few apps available that provide you with a free credit report – but there are no free lunches! By using such apps you give them access to your credit rating which they use to sell you their financial products, or worse, sell your data to other organizations.

There is an easy way to avoid such situations. As per an RBI rule, an individual can get one free credit report every year from each of the four credit agencies in India- TransUnion CIBIL, Equifax, Experian, and High Mark CRIF. This means in a year you can get 4 credit reports. While this report is not as exhaustive as a paid report, it can be used to check your credit score and verify all the information present in the report.

The information with the credit agencies generally gets updated in 30-45 days, so wait for at least 45 days after clearing any dues before requesting a report.

How To Get a Free Credit Report From CIBIL?

CIBIL is the most well-known credit agency in India, so much so that people use CIBIL score and Credit score interchangeably.

You can get your free credit report from CIBIL using this link. CIBIL has the most user-friendly process and you get your free report within minutes. You will be required to create an account and provide your ID proof number before you can access the report.

In case you find any discrepancy in your report, you may raise a dispute with CIBIL and get it corrected.

How To Get Free Credit Report From Experian?

You can generate your free report from Experian through this link.

After entering your basic details like name, PAN number, DOB, etc you will get access to the report. You can access it anytime in the future by logging in to your account.

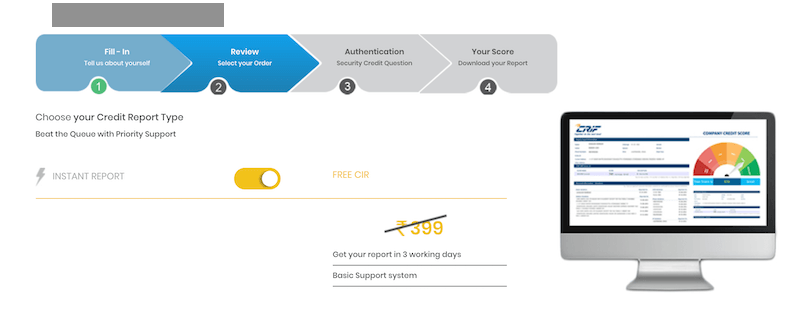

How To Get a Free Credit Report From CRIF?

You can get your credit report from CRIF using this link. If you already have an account with CRIF, click on ‘Login’ on the top right. Else click on ‘First Time User’.

You will then be asked to provide certain details, such as date of birth, and PAN number, and address.

On the next screen, you will be asked to choose between a paid report (which costs Rs 399/- and is provided within minutes) or a free report, which is provided in 2-3 working days. Once you hit submit you will receive a report authentication link on your email ID within 24 hours, and on successful authentication, the free credit report is mailed the next day.

How To Get Free Credit Report From Equifax?

Of the four, Equifax has the most primitive method of providing credit reports. To get your credit report you need to fill out the KYC form (given in the link below), attach the self-attested copy of your Identity Proof and Address Proof, and email it to ecissupport@equifax.com

Link to KYC Form

After receiving the form, Equifax will send the credit report via courier or postal service and only to an address that is present in their database.

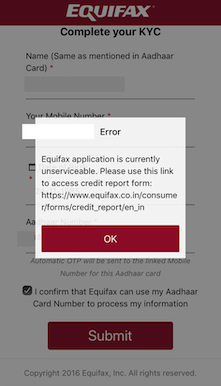

This is a very tedious and slow process and also not secure. There are chances of couriers getting into the wrong hands and with such sensitive information in the credit report, I would rather live with three free reports a year.

Note that earlier one could generate their free credit report from Equifax using the mobile app (Equifax India). However, that option is no longer available. You get the following error when you try to generate the report using the app:

Using the above steps you can get 4 free credit reports per year (3 if you decide not to get one from Equifax). If you notice that your credit score is low, you can follow these tips to improve your credit score.

While having too many requests for credit scores from lenders in a short period can lower your score, personally checking your credit score does not have any negative impact.

Let me know your experience of getting the free credit reports from the agencies directly.

Thanks for reading! I’d love to hear your thoughts in the comments below. If you found this useful, please share it with anyone who might benefit from it.

Want to stay in the loop?

To get notified when I publish my next article, you can subscribe to my newsletter here. I send an email every few weeks when I publish something new – just links to articles I’ve written, and occasionally, books or articles I found worth reading.

Photo Credit:

- Feature Image: by Stephen Phillips – Hostreviews.co.uk on Unsplash