This article is written by my wife Shivani who is a senior executive at a public sector bank.

In my previous article ‘How to improve your CIBIL score‘, we discussed the factors that influence a credit score and how one can maintain a healthy credit score. However, there could be instances when the credit score is already damaged due to incorrect information with CIBIL. Or, the Credit Score is fine but some personal information in the report is incorrect, due to which the loan gets rejected. In such situations, people rush to Credit Repair companies and pay heavily from their pocket to get the CIBIL data rectified.

What If I Tell You That You Can Fix Your CIBIL Report Yourself and For Free!

Yes, you read that right! You don’t have to pay fees to anyone for something that you can do for free. To do that you’ll first need your CIBIL report. You can get that also for free, without getting spammed! You can check my article on how to generate your free credit report.

TIP: It is advisable to generate your own CIBIL report before approaching a bank for a loan and in case of any incorrect information, you must get it fixed beforehand so that when you apply for a loan it does not get rejected. This will also ensure that your credit score doesn’t get downgraded because of multiple CIBIL queries.

What data inaccuracies can be fixed using CIBIL’s Dispute Resolution Process?

Most of the commonly occurring inaccuracies in CIBIL reports can be corrected using CIBIL’s Dispute Resolution process, such as:

Inaccurate Account Details:

At times you may notice that despite having paid your dues the data on CIBIL does not reflect that. This may happen if you fetch your credit report within 45 days of clearing your dues. The information in CIBIL usually gets updated in 30-45 days, so it is advisable to fetch your updated CIBIL after that timeframe. However, if your data has not been updated even after 60 days, then you should immediately raise a dispute report.

Incorrect Personal Details:

You may notice incorrect personal details like PAN Number, DOB, Address, Phone Number, etc. CIBIL fetches these details from your lending institutes, so you should first ensure that you have provided the correct details to these institutions. After ensuring that, you can raise a request with CIBIL to correct your details.

Inaccurate Ownership Details:

You may find accounts that do not belong to you.

Note: If the data in your CIBIL report is correct but your CIBIL score is low due to which your loan request is getting rejected, then you should follow these tips to improve your CIBIL score.

So, how do I get my CIBIL report fixed?

You can fix the inaccuracies in your CIBIL report online as well as through the mail. The online method is preferred for faster resolution.

Fix CIBIL Report Online

Here are the steps to do that:

Step 1a: Login to myCIBIL. If you have already received your free report, move to step 2.

Step 1b: If this is the first time you are logging in, you will be asked to register. After that generate your free report as explained here. Then move to step 2.

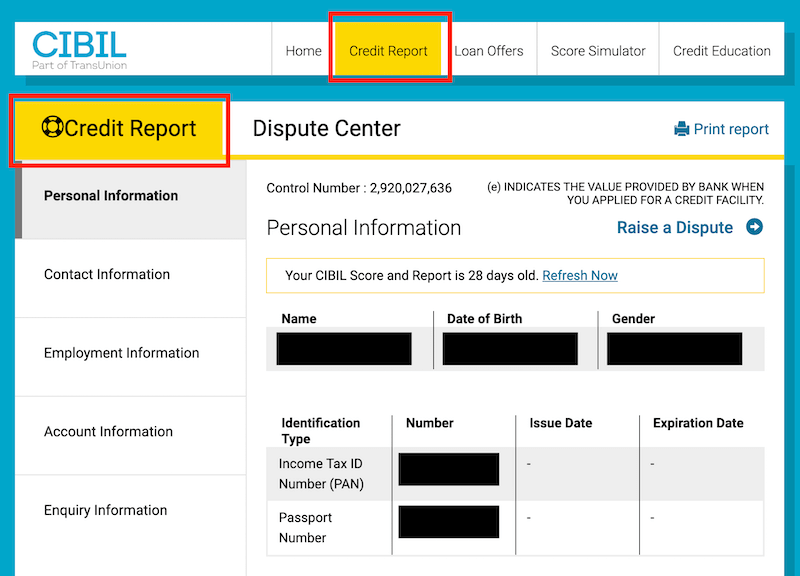

Step 2: Go to the ‘Credit Report’ section and check all the information provided there

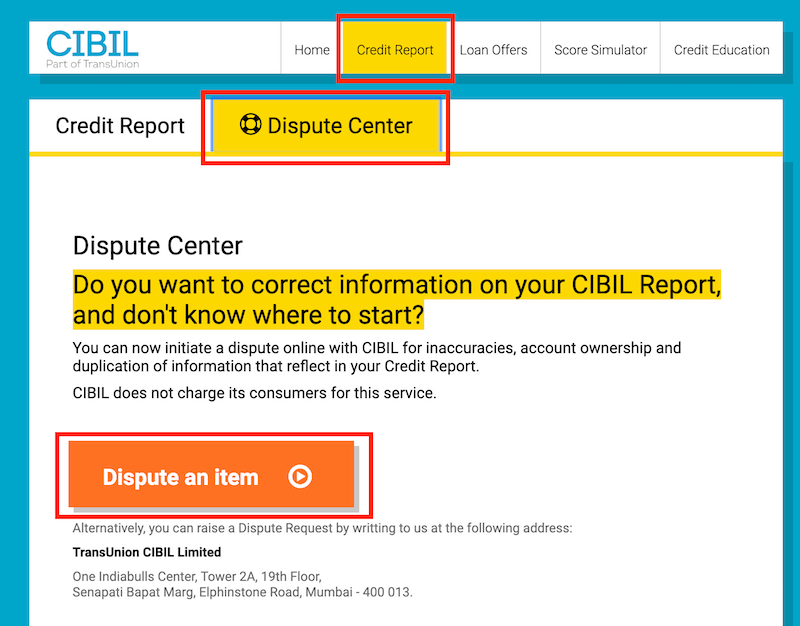

Step 3: In case of a discrepancy click on ‘Dispute Center’ and click on ‘Dispute An Item’

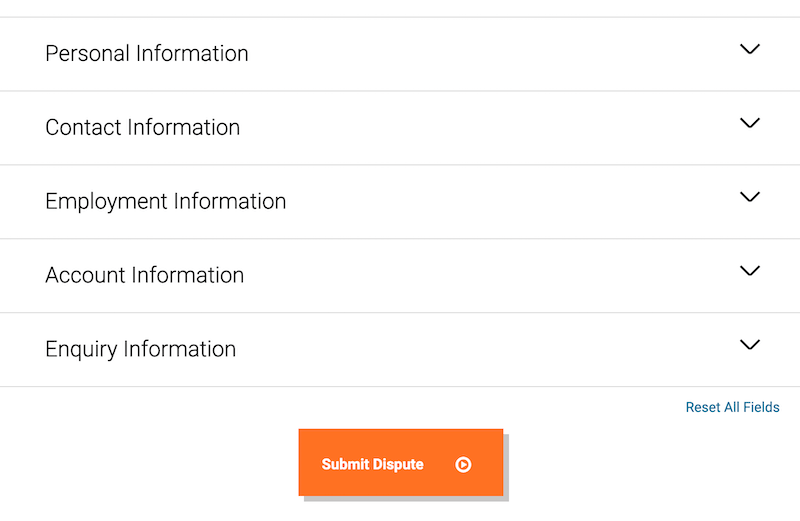

Step 4: Select the relevant section which you want to dispute and complete the online dispute form. Note that you can raise a dispute for multiple entries at the same time instead of raising multiple dispute reports

Note that it can take up to 30 days or more to get the data rectified.

Fix CIBIL Report Through Mail

Alternatively, you can raise a Dispute Request by writing to CIBIL at the following address:

TransUnion CIBIL Limited,

One Indiabulls Centre, Tower 2A, 19th Floor,

Senapati Bapat Marg, Elphinstone Road,

Mumbai - 400 013.

Using this information you can get your CIBIL report corrected and avoid getting your loan application rejected.

Do let us know if you ever got your loan rejected because of incorrect data in the CIBIL report. How did you get it fixed?

A Word from the Writer

I write about a mix of topics, including productivity, tech, books, personal finance, and more. If you’d like to stay updated, here are two ways:

- Real-Time Alerts: Join my WhatsApp Group or WhatsApp channel, (or both!), to get instant notifications for new articles, fascinating book excerpts, useful web finds, and more.

- Monthly Email Digest: Subscribe to my Email Newsletter and receive a curated end-of-month roundup of everything I’ve written, along with handpicked gems from across the web.

I also create Google Sheets templates to automate and streamline workflows. You can check them out here. Feel free to reach out if you need a custom template made for you.

If you’ve enjoyed reading, please consider supporting the blog with any amount you like. Your contribution helps cover server and domain costs, ensuring the blog keeps running.

Photo Credit:

- Feature Image: Photo by Scott Graham on Unsplash