This article is written by my wife Shivani who is a senior executive at a public sector bank.

Did your credit card or loan application get rejected by a bank? It could be because of a low credit score. This post will help you understand how your credit score gets impacted and what can you do to improve it.

But first, let’s understand what a Credit Score is.

Your Credit Score is an important metric if you are applying for a loan or a credit card. A credit score is a 3-digit numeric value assigned to your credit history. When you apply for a loan or a credit card, lending institutes (banks or any other agency) reach out to the authorized Credit Information Bureaus (CIB) to fetch your credit history. It is based on this report that banks and other money-lending institutes decide if they can take the risk of lending you money/credit cards or not.

How does the CIB get information about my credit history?

CIBs get credit and loan-related information from lending institutes. When you make a payment towards your credit card, or towards your loan, the CIB is informed about it. If you have taken loans from multiple banks, CIB gets the information from all of those. It knows when you miss a payment. It collects all this information and creates a credit report for you and assigns a credit score.

There are 4 CIBs in India, with CIBIL being the most popular among all:

1) CIBIL

2) CRIF

3) Equifax

4) Experian

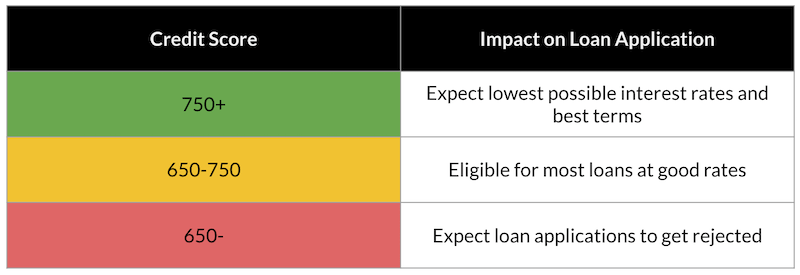

While the first three provide a credit score in the range of 300-900, Experian uses a range of 330-830. A credit score of 750+ is considered excellent, while anything below 650 is considered poor.

As per an RBI rule, you can request one free report every year from any of the CIBs. Even if you are not planning to take a loan or apply for a credit card, it’s a good idea to check your credit score from time to time to see if there are any red flags and to avoid any errors or fraudulent activities (such as a loan that you have not taken showing up in your credit report) that may unnecessarily bring your score down.

Ok, can you tell me how to improve my credit score?

Certain factors go into determining your credit score:

Credit Payment History

CIBs look at the percentage of on-time payments made towards your loan or credit card in the last 36 months. Paying your EMIs and credit card bills before the due date and in full helps in ensuring a good payment history.

This factor has a high impact on the credit score, constituting as much as 33% weight for some agencies like CIBIL, so make sure that you pay at least a week before the due date to ensure you have enough time in case the payment fails. And always pay the whole amount! Do not fall into the trap of paying the minimum amount, as it not only brings down your score but you also end up paying high interest on the remaining amount.

Note that in the case of co-signed, guaranteed, or jointly held accounts, you are held equally liable for missed or late payments.

Credit Card Utilization

Credit card utilization again plays an important role in deciding your credit score.

Keep your utilization percentage (the amount used/credit card limit) low to maintain a high score. As a rule of thumb avoid using more than 50% of your card limit in any given month. Using more than 50% of your card limit signifies that you might be credit-hungry and you might not be left with enough money at the end of the month to pay the due amount. This causes your score to drop.

If you notice that you are continuously utilizing more than 50% of your credit card limit, it’s time to request the bank to increase your credit limit.

Duration of Credit History

While this does not have a high impact, having an old & active credit card or a loan helps in maintaining a high score, provided the above two criteria are also met. So, if you have multiple credit cards and you are planning to surrender one of those, it is better to surrender the relatively newer card.

Credit Mix

While this does not have a high impact, it is better to have a healthy mix of secured (such as home loans and auto loans) and unsecured loans (such as personal loans and credit cards). If you have too many unsecured loans, it may impact your score negatively. But here again, the first two factors play a significant role.

Number of loan/credit card applications in a short period

Avoid taking too many loans or credit cards in a short duration of time. Every time you make such a request to the bank they reach out to the CIB to check your score. This has a dual impact

- one, it sends a signal that you are borrowing heavily,

- and two, in case your application is rejected by the lending institute it adds a negative mark to your report. Too many negative marks in a short duration pull down your score.

In case your credit score is low, work on the above five factors. You will soon start seeing an improvement in your credit score.

Let me know in the comment section below how useful this article was in improving your credit score. And if you already have a good credit score, do share some of the best practices in the comment section.

Thanks for reading! I’d love to hear your thoughts in the comments below. If you found this useful, please share it with anyone who might benefit from it.

Want to stay in the loop?

To get notified when I publish my next article, you can subscribe to my newsletter here. I send an email every few weeks when I publish something new – just links to articles I’ve written, and occasionally, books or articles I found worth reading.

Photo Credit:

- Feature Image: Photo by engin akyurt on Unsplash