While this article is primarily aimed at current Uber India employees who have received Uber shares through ESPP or RSUs, it may also be useful for employees of other companies that utilize Shareworks, a product from Morgan Stanley, for managing employee RSUs.

When can you sell your Uber shares?

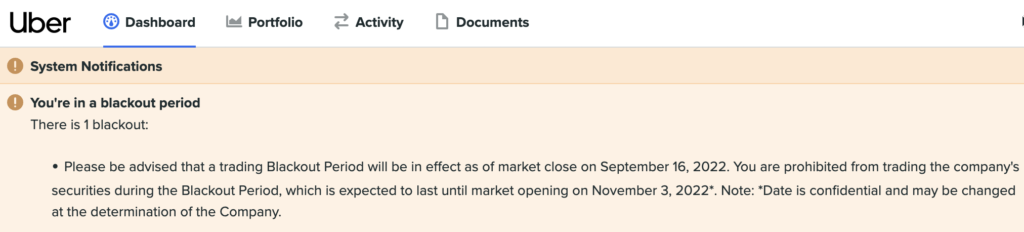

As long as you are employed with Uber you can sell your Uber shares (RSUs and ESPP) only outside of the blackout period. Shareworks (the company that Uber uses to manage its employee stock options) shows if you are in the blackout phase.

Update: Blackout is no longer applicable to all the employees. Only employees above a certain level or those in roles with access to sensitive information are put in blackout.

How To Sell Your Uber Shares?

Step 1

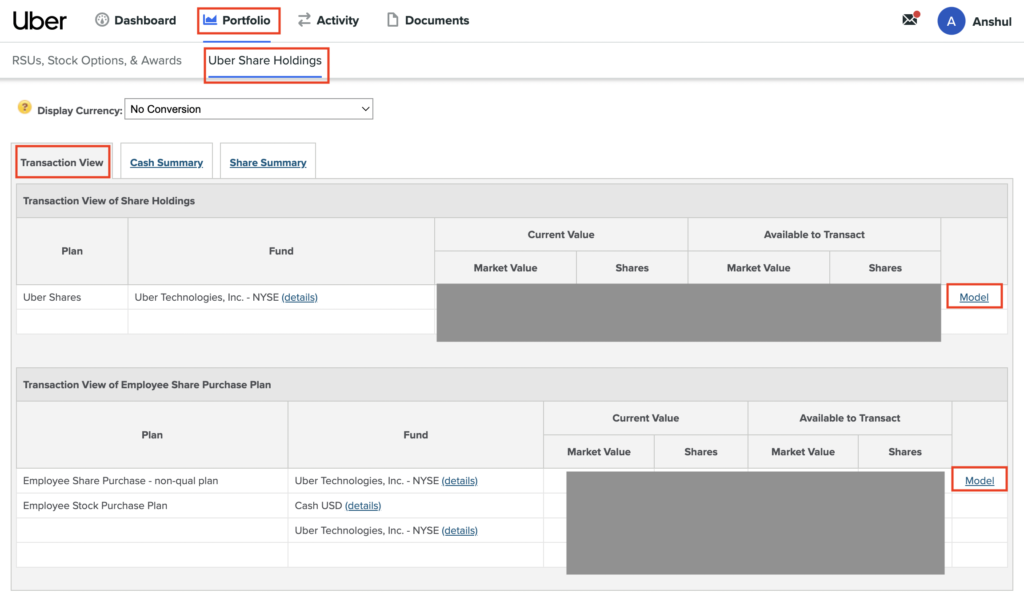

Go to Shareworks -> Portfolio -> Uber Share Holding

Here under the Transaction View Tab, you will see your RSUs and ESPP units listed separately.

Depending on whether you want to sell RSU or ESPP, click on the corresponding ‘Transact’ link.

Note: You would have noticed a link called 'Model' in the screenshot above. Think of this as trying the transaction in a sandbox environment without actually selling.

Step 2

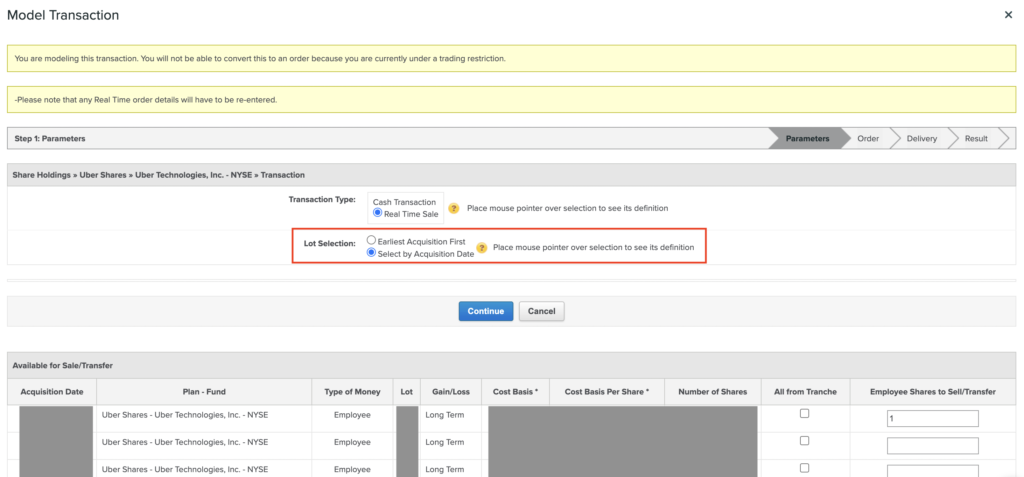

On the next screen, you need to select the lot you want to sell – you can either use the default FIFO option (‘Earliest Acquisition First’) or select the lots by acquisition date, which requires you to select the lots manually.

I use the manual option to select those lots that result in minimal capital gain (considering both conversion rate and purchase & sale price). More about capital gain here.

Note: The Gain/Loss column that you see in the screenshot is not as per Indian taxation laws. According to Indian IT rule, foreign equity held for less than 2 years is considered as Short Term and is taxed at slab rate. Long-term capital gain is considered for equity held for more than 2 years.

Step 3

Select the order type on the next screen:

- Market: Order gets executed at the market price

- Limit order with a Good Till Date (GTD): The Order gets executed at the Limit Price set by you or higher and remains in effect until the date specified by you (not more than 365 days), or until the order is completely executed.

- Limit order with a Good Till Cancel (GTC): The order gets executed at the Limit Price set by you or higher and remains in effect until the order is completely executed or canceled by you.

Both GTD and GTC order automatically gets canceled when you enter the blackout phase.

Step 4

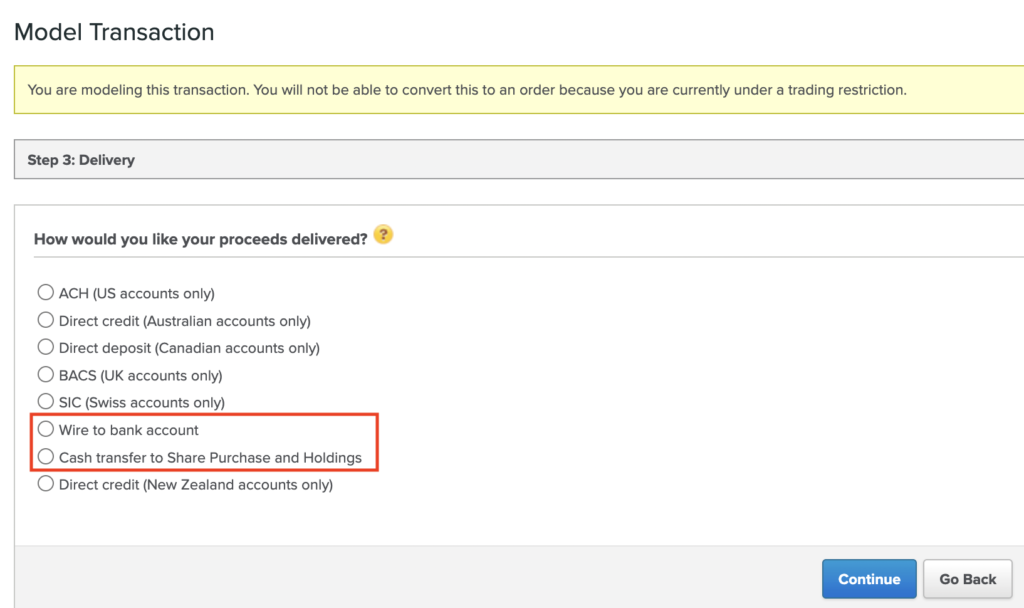

This is where you decide how you want to receive the funds. Assuming you do not have any overseas account, you can select either of the highlighted options shown below:

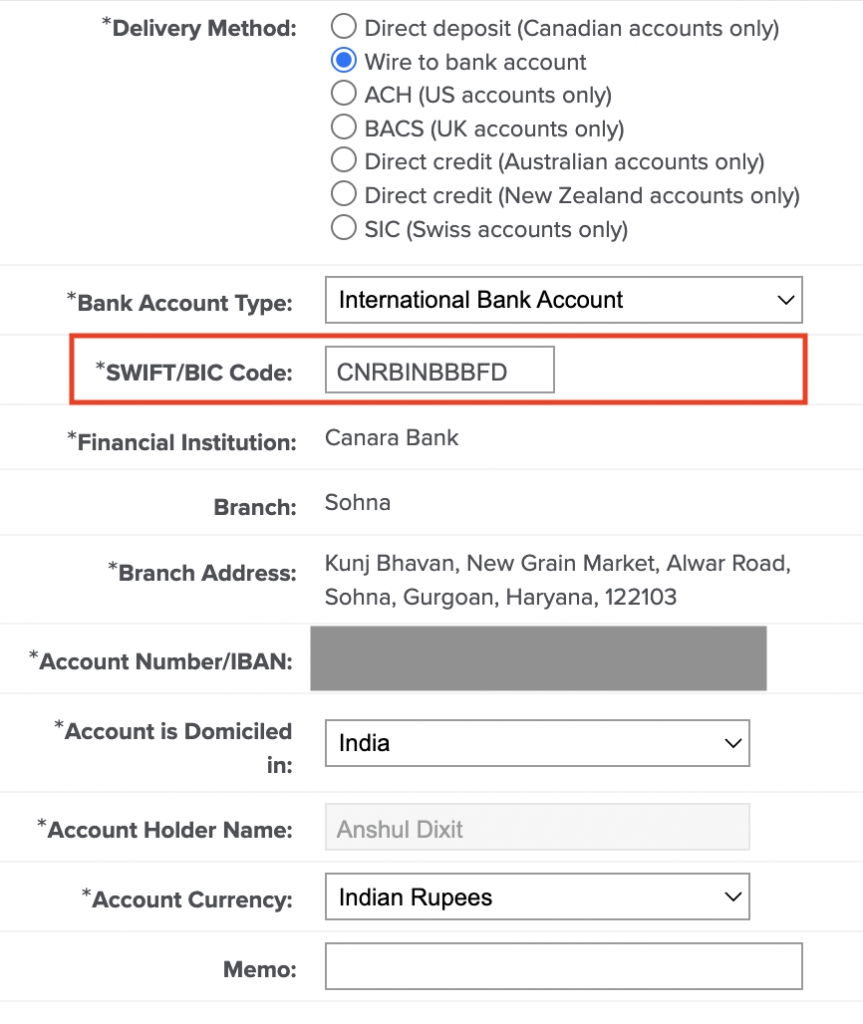

If you want to send the sale proceeds to your Indian bank account, use the first highlighted option – ‘Wire to bank account’. If this is the first time you are selling your Uber shares, you will be asked to link a bank account. This is how the form looks:

You can get the Swift code for your bank online or by calling customer care.

Shareworks has recently partnered with HSBC for funds transfer. Due to this, if you mention your Account Currency as Indian Rupees, HSBC does the USD-INR conversion at its end and then does an NEFT transfer to your account. This could result in sub-optimal conversion rates as you no longer have the option to negotiate the rate with your bank, and you also pay additional charge to HSBC. (as explained below). To prevent that, you can change the Account Currency to USD.

If you select the second option, i.e., ‘Cash Transfer to Share Purchase and Holding’, the sale proceeds are held with Shareworks. This is a useful option if you plan to sell on multiple occasions and want to reduce the wire transaction charges. You can hold the amount with Shareworks and transfer all the funds to your bank account in one go to minimize wire transaction fees. But your money sits idle in this case. If instead, you transfer the funds immediately after the sale of shares, you can invest them somewhere else. So, weigh the pros and cons before deciding.

Note: As per the Regulation 22, sub-regulation (4) of FEMA Regulation Act 2004 (and subsequent amendments in 2005, 2007, 2012, 2013), foreign sale proceeds must be “repatriated immediately on receipt thereof and in any case not later than 90 days from the date of sale of such securities.”

Step 5

This is the last screen and it shows you a summary of your order. Hit submit if everything looks ok.

Note again that the Loss/Gain category here is not as per Indian tax laws. As mentioned earlier, foreign equity held for less than 2 years is considered as short-term.

In this screen, you will also see the conversion rate. More on that later.

Transaction Charges

You pay the following charges on the sale transaction:

| Type | Charged By | Amount |

|---|---|---|

| Transaction Fees | Shareworks | Few cents |

| Wire Transfer Fees | Shareworks | $10 per wire |

| Bank Transaction Charges | Indian Bank | Varies; can range anywhere between $0 to $10 (as per my experience of using a pvt and a public sector bank) |

| FX Conversion Fees + GST | Indian Bank | Varies |

What Conversion Rate Is Used By The Bank?

The conversion rate that you see on the Shareworks transaction summary is not what your bank uses when converting USD to INR. Your bank will use the forex rate on the date when the money hits your account.

The conversion rate varies from bank to bank. This is due to the different spread (difference between the buy and sell price of currency) used by banks. In my experience, public sector banks offer a better conversion rate than private sector banks.

Tip: You can drop a mail to your bank asking for a better rate. If you have a good standing with the bank, they might agree to it. I tried this with Icici Bank and got an additional 60p per USD.

When Do I Get The Money In My Account?

It could take up to 7 days after the sale of the shares for the money to hit your Indian bank account. In some cases, you might get a call/mail from the bank to confirm the reason for getting funds from the US.

Tax Liabilities On The Sale Of Shares

Just as you pay capital gain tax on selling your shares and mutual funds, you are required to pay the same when selling foreign equity held by you. In addition, you need to disclose your foreign stocks in schedule FA of the ITR form. The process of calculating capital gain is quite different for foreign stocks – you can read more about that here.

Hope this helps! Feel free to reach out for any questions through comments or 1:1.

A Word from the Writer

I write about a mix of topics, including productivity, tech, books, personal finance, and more. If you’d like to stay updated, here are two ways:

- Real-Time Alerts: Join my WhatsApp Group or WhatsApp channel, (or both!), to get instant notifications for new articles, fascinating book excerpts, useful web finds, and more.

- Monthly Email Digest: Subscribe to my Email Newsletter and receive a curated end-of-month roundup of everything I’ve written, along with handpicked gems from across the web.

I also create Google Sheets templates to automate and streamline workflows. You can check them out here. Feel free to reach out if you need a custom template made for you.

If you’ve enjoyed reading, please consider supporting the blog with any amount you like. Your contribution helps cover server and domain costs, ensuring the blog keeps running.

This is a very helpful article Anshul, Thank you so much for writing this!

Well explained. Thanks!

Nice blog ! Quite helpful.