Update for 2025 Tax Filing (Deadline: Sep 15th): I built a Google sheet template that makes filling Schedule FA a breeze. It is trusted by employees of Uber, Amazon, Intel, Qualcomm, and more. I have now launched a significantly upgraded v2 template for the current tax season.

New v2 Features Include:

* Automatic dividend income calculation for Table A3 of schedule FA.

* Pre-filled SBI TTBR data from Jan 2020 to Mar 2025.

* A one-click option to download your Schedule FA data as a CSV to share with your CA

Get the v2 Template Now & File with Confidence

Though Schedule FA was introduced in the ITR forms in FY 2011-12, many taxpayers are still unaware of its compliance requirements. For the uninitiated, Schedule FA is a section in ITR form used to report foreign assets. Until a few years ago only a small percentage of tax paying residents had any foreign assets to declare – mostly employees of US-based companies who received shares as part of the compensation packages.

Today, due to the combination of multiple factors – more foreign companies establishing offices in India, more companies adding RSUs as part of compensation package, the rise of fintech companies that allow anyone to purchase shares in foreign stock markets, and finfluencers promoting such apps (largely for their vested interest) – there is an increase in the number of people who hold foreign shares.

Despite this, there is still a lack of education among the masses about the compliance requirements of such investments. Even some CAs lack knowledge about Schedule FA’s intricacies, such as the rules regarding the reporting period, conversion rates, etc. Some years ago, I consulted several CAs for filing my return. Most were unaware of the nuances of schedule FA, and a few who could convince me with their knowledge were charging a bomb – as much as 30K for filing return!

The situation may be better today, and you might find a knowledgeable CA at a reasonable cost. But even if you hire them to file your income tax return, it is in your interest to know the rules to ensure you are compliant. The penalty for non-compliance in case of foreign assets is huge, with fine of Rs 10 lac and/or imprisonment up to 7 years under the Black Money Act, 2015 (see section 42, 43, 49, 50; here is another link from Income Tax website). Recently, the Mumbai bench of ITAT upheld a penalty of Rs 10 lacs on a woman who failed to properly disclose her foreign assets in the past. “I didn’t know” isn’t exactly an excuse the taxman cares about when they come knocking at your door.

Now as some of you know, I prefer filing my tax return on my own. I am sharing my understanding of schedule FA here for anyone to refer and use, but more importantly, to create a reference doc for myself. Since I follow what I have written here for filing my income tax return, I have taken utmost care to be correct in my understanding, spending considerable amount of time to understand the rules that are applicable to me and going through various articles, rules and notices that I could find online.

But I am no tax expert, and I don’t claim to be one. So, if despite all my research and thoroughness, I’m wrong about something here, which could result in an error in my IT return, I take responsibility for that and its consequences. But, as I hope you can understand, I cannot take responsibility for any issues you face after following what I have written. Use this article as a reference, but when in doubt, please do your own research to figure out the right approach for yourself—or better yet, hire a professional.

Note: This article is only for Schedule FA. If you have sold any foreign shares check this article on how to report capital gain for such shares – it is different from how we do it for Indian stocks.

How to fill Schedule FA?

While schedule FA applies to any foreign assets, I’ve limited this post to the discussion around shares. The underlying concept wouldn’t change much for any other foreign asset, but you will have to use the relevant table based on the kind of foreign asset you hold.

Here are the guidelines for filling schedule FA of ITR for foreign shares:

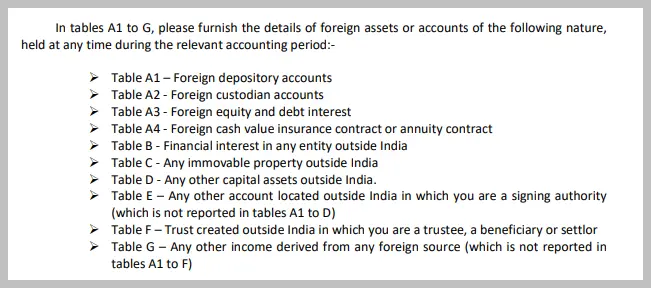

Choose the Right Table: There are different tables in Schedule FA. Going by the explanation of each table (see image below), I believe that deposits made in a bank account should be recorded in Table A1, deposits to the US Trading account (e.g. IBKR) should be reported in Table A2 and shares held (irrespective of the broker) in Table A3.

I know a few CAs who use tables B or D because reporting in Table A requires more information – underscoring the need of knowing the rules even if you delegate the task to someone else.

I personally use table A3. In case you were using some other table previously, you should consult a knowledgeable CA before changing it.

Report All Foreign Shares: All your foreign shares should be reported under Schedule FA. It doesn’t matter if you sold them in the financial year; if you held anything even for a day, you need to report it. While I could not find any latest document regarding this, it is mentioned in this guide published by Income Tax dept for AY 2020-21: “…held at any time during the relevant accounting period” (see page 33) [Link].

Include Employer-Granted or Gifted Shares: Even if these shares were not purchased by you but given to you by your employer as part of compensation, or gifted to you, you need to report them. You don’t have to report unvested shares.

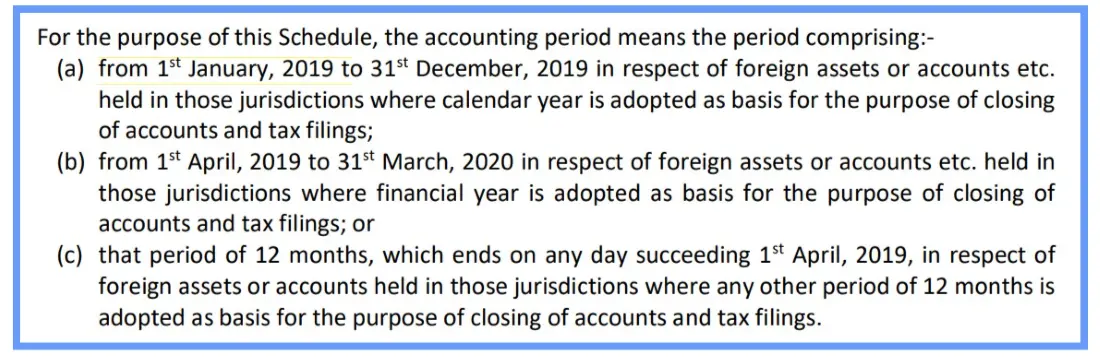

Use the Accounting Year of the Foreign Country: Unlike other sections of ITR, for Schedule FA reporting you need to use the accounting year of the country where your foreign assets are held:

For example, I get Uber stocks as part of my compensation, and as these are held in the US, I need to use the accounting year of the US, which follows the calendar year. So, for FY 2023-24, I’ll report all shares held between 1st Jan 2023 – 31st Dec 2023.

Example of an Entry in Schedule FA – Table A3

Here is a list of columns in A3, and what goes there. I have used Uber as an example. This is based on my understanding and what I have used while filling schedule FA for the shares I have. Take your own call. (scroll to right to see the complete table, there are 11 columns)

You can now purchase my extensively tested Google Sheet template, trusted by employees of Uber, Amazon, Intel, Qualcomm, and more. It’s available at a nominal cost via the payment link. You can see it in action here.

When you purchase, the link to access the template will be on your payment receipt. Simply click the link and ‘Request Access‘ to get added to the Google Sheet. Please use the correct email ID when purchasing, as access will be tied to that id.

If you are a DIY-kind of a person, read these steps to build a similar template for yourself.

| Country (A) | Name of entity (B) | Address of entity (C) | ZIP code (D) | Nature of entity (E) | Date of acquiring the interest (F) | Initial value of the investment (G) | Peak value of investment during the period (H) | Closing balance (I) | Total gross amount paid/credited with respect to the holding during the period (J) | Total gross proceeds from sale or redemption of investment during the period (K) |

|---|---|---|---|---|---|---|---|---|---|---|

| United States of America | Uber Technologies Inc | 1515 3rd St. San Francisco, CA 94158 | 94103 | Listed Company | Vested Date in case of RSU Purchase Date in case of ESPP or direct purchase One row per transaction | FMV of Uber share on the date in col (F) x No. of Shares Received x SBI TT Buy Rate | Peak Value of Your Investment in the CY in USD x SBI TT Buy Rate when peak investment value was reached — x No. of Shares held on the day peak price was hit x SBI TT Buy Rate | Share Price on 31st Dec of the year x No. of Shares held on this day x SBI TT Buy Rate | If you earned any dividend in the accounting period, that should be mentioned here. | If you sold any shares in the accounting period, report that amount here. |

Notes:

- By no. of shares received (col G) I mean the number of shares that were credited to your account, and not the shares that got vested. If 100 shares were vested, and 40 were sold by your company to cover taxes, 60 would get credited to your account. That is what goes here.

- An earlier version of this article considered the stock’s highest price in the calendar year (CY) to calculate the peak value of the investment (Column H). As pointed out by one of our readers, if you sold some stocks during the year, your peak investment value might have been reached on a different date than when the stock hit its peak price.

For instance, if you had 10 shares at $50 on February 1st and sold 6 before the price peaked at $60 on February 20th, your investment was worth more on February 1st ($500) than on February 20th ($240).

Therefore, I have revised Column H to consider the peak value of your investment. If no shares were sold, the peak value coincides with the stock’s peak price date. Otherwise, it reflects the highest value reached before any shares were sold.

The template that I have built for myself takes into account all the finer nuances of Schedule FA. You can read more about it here and purchase if it suits your requirements. When you purchase, the link to access the template will be on your payment receipt. Simply click the link and 'Request Access' to get added to the Google Sheet. Please use the correct email ID when purchasing, as access will be tied to that id.

What SBI TT Buy Rate is Used for Each Column?

- For initial value of the investment (col G), use SBI TT Buy Rate on the date of investment

- For peak value of investment during the period (col H), use SBI TT Buy Rate on the date when peak price was hit

- For closing balance (col I), use SBI TT Buy Rate on the closing day of the year

Reference: see page 35 of the ITR instructions for AY 2020-21 [Link]

Note:

For peak value of investment, some people suggest using the highest closing price, while others recommend the highest price, which may not be the closing price. I use the highest price and not the highest closing price. This means I might overreport the peak value but never underreport. I don’t think the IT department will have any issue with overreporting.

How to find the SBI TT Buy Rate?

SBI publishes TTBR each day on its website. But unfortunately, there is no archive to get the historical data. But a few good people have created a repository of historical TT Buy Rates that you can use:

- https://github.com/skbly7/sbi-tt-rates-historical

- https://github.com/sahilgupta/sbi_forex_rates/tree/main/pdf_files

There are 2 rates for each day, use the one that’s in the table titled “to be used as reference rate”.

Parting Thoughts

There are a lot of entries to be made in Schedule FA if you do it the right way (which is the only way to do it, by the way). There is also a high chance of making an error. While I have only written about table A3, if you are moving funds to another broker in the US, or to another bank account to purchase shares later, you will have to fill out other relevant tables too. And the laws around black money and FEMA are quite strict.

This is why I tell my friends who want to get a taste of US stocks that they’d be better off doing it through Indian mutual funds that invest in overseas markets. You wouldn’t have to worry about filling out Schedule FA if you go this route.

But unfortunately, not everyone likes the boring way of doing things!

So, if you want to invest in US stocks (or stocks of any other country) for diversification or any other reason you have given yourself to justify the itch, do it only if you are investing a significant amount. If you are doing it just to add some ‘tadka’ to your portfolio because some finfluencer told you to, it’s not really worth the effort required, the risk, and the headache it comes with. And for all the pain you took, you are not diversified if it is just a minuscule percentage of your entire portfolio.

Thanks for reading! I’d love to hear your thoughts in the comments below. If you found this useful, please share it with anyone who might benefit from it.

Want to stay in the loop?

To get notified when I publish my next article, you can subscribe to my newsletter here. I send an email every few weeks when I publish something new – just links to articles I’ve written, and occasionally, books or articles I found worth reading.

Permanent links for Black Money Act and IT Rules listed in the article:

Hi Anshul, I am working on this and checked. I am working on this schdule since 2020. But your solution is much better.

I have one doubt here “how to incorporate Split transactions in the spread sheet”

If you have some idea please let me know. During the year there are many splits like for Apple, Telsa, NVIDIA etc.

Thanks and regards,