Even before I got my first paycheck, I had my plan ready on how I would spend my salary – I wanted to purchase the best clothes, party at the best pubs, and purchase the latest gadgets.

I continued this lifestyle for quite some time. I never worried about saving anything, whatever was left at the end of the month would be my saving for that month.

Then a close friend got admitted to the hospital for surgery and five of us decided to bear the charges till his parents arrive. That was the first time I realized that my bank account did not have anything substantial to show for the year worth of paychecks! I felt ashamed.

I made many such mistakes 10 years ago when I started earning and lost money by making bad financial decisions. But those experiences made me value money, and I took steps to learn from my mistakes and become better at managing my personal finances without the need for any financial advisor.

I have put together those learnings in this article. I hope it will help you learn from my mistakes and equip you to make better financial decisions.

1) First Save, Then Spend

A lot of people approach savings as:

Savings = Income – Expenditure

However, the correct way to approach it is

Expenditure = Income – Savings

i.e., first save, then spend.

There are a few necessary recurring expenditures that you will have to take care of, such as:

- Room Rent, Electricity, Maintenance, etc

- Internet Bill

- Phone bill (keep it to a minimum)

- Food

- Conveyance

Every month when you get your salary, take out the portion required for these necessary expenditures. Save a part of whatever is left and only then spend the remaining amount.

In fact, instead of saving a random amount every month, decide on a fixed amount that you will be saving. Treat your monthly savings goal like a bill. At the beginning of the month hold yourself accountable to pay it off like you would your rent or EMIs. This will instill a sense of discipline.

2) Do Not Mix Insurance & Investment

When you start earning a lot of Insurance agents will reach out to you and try to sell products that give the benefit of Insurance as well as a “good” maturity amount. These are called ULIP (Unit Linked Insurance Plans). Just run away from them. As fast as you can.

Why do I say so?

ULIP gives customers both insurance and investment under one plan. While this may sound like the best of both worlds, in reality, it is not. ULIPs actually do a bad job at both insurance and investment.

- If you compare the return of ULIPs against Equity Mutual Funds you will find that Mutual Funds outperform ULIPs by a considerable margin.

- If you compare the premium that you pay for a ULIP with that of a Term Insurance Plan, you will find that premium for ULIPs is many times higher than that of a Term Insurance.

Term Insurance is a pure Insurance product with no maturity value. If something bad happens to you, your dependent gets the maturity amount, otherwise, you don’t get anything back when your policy expires.

Though the Term Insurance plan won’t give you anything at the end of maturity, the premium that you pay for the Term Insurance plan is much lesser than for ULIPs (think 4K vs 40K per annum). You can get a better return by investing that difference in some good investment plans.

Just remember that insurance is not an investment product. Insurance is bought to provide financial security to your dependents should something happen to you. So, if you have dependent family members, buy a term insurance policy for yourself.

Note that if you buy insurance at an early age, your yearly premium will be very less.

Another advantage: you can claim tax benefits on the premium that you pay.

3) Buy Medical Insurance

A lot of companies these days provide a family floater health cover to employees, which covers your entire family. So, people don’t see a need to buy separate medical insurance. But take my advice and buy one for yourself and your family even if your family is covered by your company’s medical policy.

Five reasons for that:

- It is cheaper & easier to get medical insurance when you are young.

- If you were to leave your job and join a company that doesn’t provide medical cover, you will be at risk of paying everything from your pocket should something unfortunate happen.

- If you purchase medical insurance early and at a later stage in life you get diagnosed with some ailment, you would have already passed the waiting period criteria that most medical insurance policies come with and so your claim will not get rejected.

- Most medical insurance policies have 2-4 years of a waiting period for pre-existing diseases. By purchasing a policy early in your life, when you are already covered by your organization, you can easily pass the waiting period on your personal policy by using company policy for such cases. In the future, if you don’t have your company cover, you will not be left to hang dry should you or a family member get hospitalized for a pre-existing disease.

- After your retirement, you wouldn’t have to rely on your children to take care of your medical emergencies.

Additional benefit: you can claim tax benefits on the premium that you paid.

4) Maintain a Contingency Fund

Have at least 6 months of your monthly salary in a savings account or a liquid mutual fund (with very low risk). This is your emergency fund so you don’t want to put it in any risky investment instruments. Keep this in a separate bank account – not your salary account – and preferably one that offers a high-interest rate (e.g. DBS bank) or sweep-in facility. Don’t keep its ATM card in your wallet.

If you lose your job or decide to leave it for some reason, you can survive for 6 months maintaining the same lifestyle while looking for a new job.

Don’t touch this bank account. Use it only in case of dire emergencies. And refill it as soon as you can.

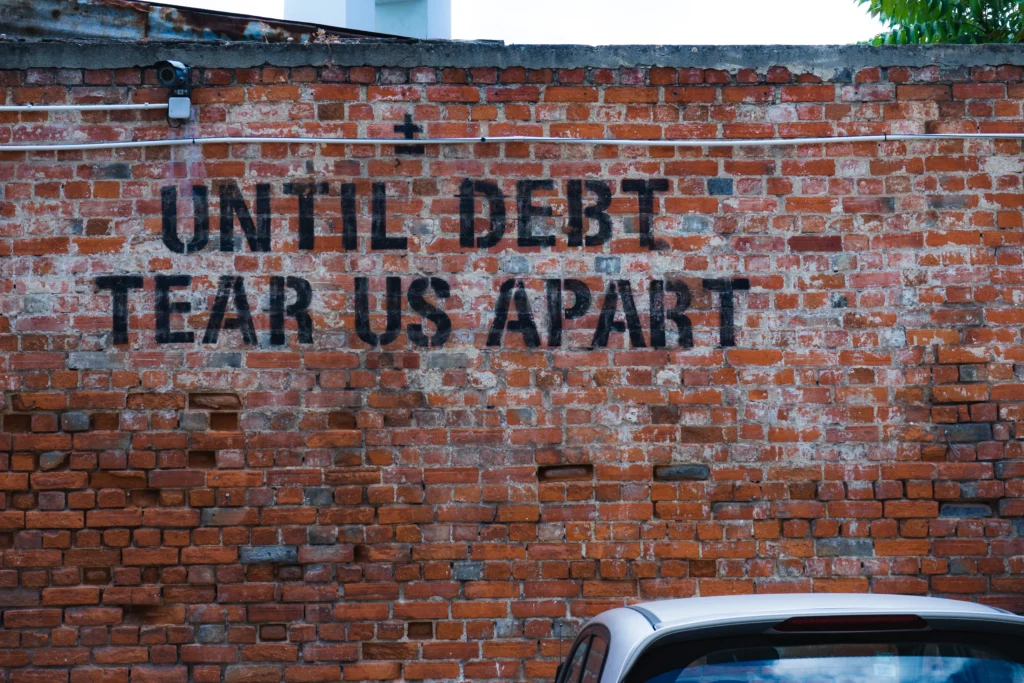

5) Don’t Take Loans for Depreciating Assets

As far as possible, avoid taking loans for depreciating assets. Depreciating assets are the assets that lose their value over time, like a car, tv, mobile phone, etc. Don’t purchase these things to show off your wealth. Purchase only what you need and what you can afford without taking a loan.

Well, for some big-ticket purchases you may still need a loan, such as for a car, but then try to keep the loan amount to a minimum – if possible, delay the purchase till you have enough savings. (Why would someone spend tens of lacs on a swanky car only to spend hours stuck in traffic is a thought that continues to baffle me! But to each their own!)

So, if you should not take loans for depreciating assets, how should you buy them?

6) Put money in a Recurring Deposit or Overnight Fund to Buy Expensive Items

To purchase an expensive item like a smartphone, tv, etc, instead of taking a loan or burning your saving all at once, plan ahead and open a recurring deposit.

Let’s say that you want to buy a phone which costs Rs 30K. Rather than spending 30K at once, set a timeline to buy the phone and start saving every month towards it using Recurring Deposit (RD). This will have four advantages:

- By waiting for a few months, you’ll realize if you really want that phone or if it was an impulsive decision

- You will inculcate a habit of saving and planning your expenses

- Your pocket won’t feel the burden all at once.

- You will earn extra interest from RD

This is what I do for all major expenses. I love purchasing gifts for my extended family during Diwali, so to avoid any shock, I put a fixed amount every month towards that goal in an RD.

7) Use Credit Card Wisely

There are many advantages of having a credit card – it is the easiest way to build your credit profile, and if you use it wisely you can build a healthy credit score that will be useful if you ever need a loan. You also get reward points when you purchase using a credit card, which you can redeem for flight tickets, Amazon vouchers, etc.

Having said that, it is also very easy to spoil your credit profile if you misuse your credit card. Be disciplined in your use of credit cards. Spend only what you can later pay. Do not fall into the debt trap by not paying your bill or paying only the minimum balance. When you default on your credit card payment, you not only end up paying a lot of interest but your credit score, which is maintained by CIBIL and other credit agencies, also goes down. Banks can refuse your loans if you have a poor credit score.

Here are some tips to improve your credit profile

8) Don’t Keep All Your Money In a Savings Bank Account

Putting all your money in a savings bank account is the dumbest way of investing money. You earn 3-5% of interest on it, while the average inflation rate in India in the last 10 years stands at 6%. This means that if you had kept all your money in a savings account in the last 10 years, your purchasing power would have gone down.

(Source: http://www.tradingeconomics.com/india/inflation-cpi)

Instead, invest in mutual funds & stocks to beat inflation. If you are new to the stock market, do not rely on so-called hot tips. Do your research before investing. Or, take the monthly SIP route.

A word of caution: learn about investing before venturing into Mutual Funds and Stocks, or you may end up losing your hard-earned money.

Having said that, do keep some amount in your savings bank account also as an emergency fund so that you can use it at a short notice.

9) Save For Your Retirement

Start saving for your retirement from the very first day. Do you know how much a cup of coffee that costs Rs 100/- today may cost 30 years later? Almost, Rs 550/-! (at a 6% inflation rate).

You need to start saving for your retirement early and in a way that you can beat inflation. Don’t just rely on your company’s PF plan, that won’t be enough. There are many investment instruments in the market – mutual funds, stock market, government bonds, saving schemes, etc. – learn about those and start investing.

10) Keep a Track of How Your Money is Growing

Nothing will motivate you to earn more & save more than seeing your net worth increase.

Thanks for reading! I’d love to hear your thoughts in the comments below. If you found this useful, please share it with anyone who might benefit from it.

Want to stay in the loop?

To get notified when I publish my next article, you can subscribe to my newsletter here. I send an email every few weeks when I publish something new – just links to articles I’ve written, and occasionally, books or articles I found worth reading.